CHICAGO (NewsNation Now) — Many families are feeling the pressure of pandemic closures and shortages, but with inflation at a 40-year high, families aren’t only feeling the pressure of higher prices at the grocery store and gas; they’re now feeling it even more with day care expenses.

The average annual cost of day care for infants now exceeds public college tuition in most states, and it’s only getting worse.

According to Child Care Aware of America, the average national cost of day care hit just over $12,300 a year in 2020, an increase of $1,000 over the prior year.

In the Midwest, Northeast and South, the annual price of day care for an infant exceeds the cost of housing.

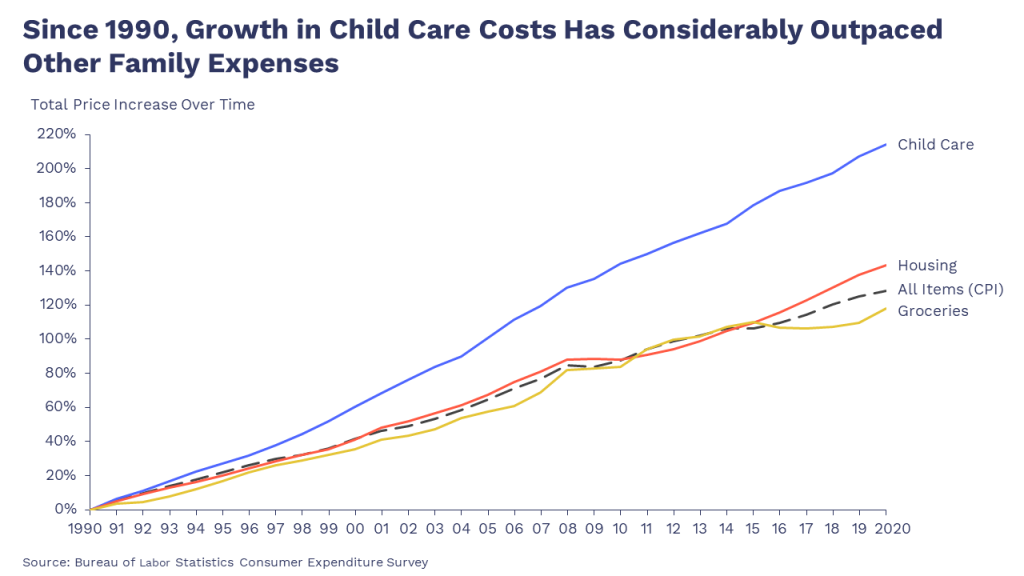

Over the past three decades, child care costs have accelerated farther than other basic family expenses, including housing and groceries, according to a separate report by the First Five Years Fund, which advocates for affordable child care.

“Since 1990, child care costs have risen 214%, according to the Bureau of Labor Statistics (BLS) Consumer Price Index analysis, while the average family income has increased by 143%,” the First Five Years Fund report said.

Inflation hit 7.5% in January, and many parents feel the pressure as they’re spending more on rent, food and home essentials.

So, what can you do to save money and keep your kids safe? Here are a few ways.

The Child Care and Development Fund assists low-income families who need child care due to work, work-related training or if they’re attending school. To be eligible for this program, you must be a parent or primary caregiver responsible for children under 13 years of age, or under 19 if incapable of self-care or under court supervision who needs assistance paying for child care; and must also characterize your financial situation as low income or very low income.

There are also Head Start and Early Head Start, which are free, federally funded programs. If you qualify, any child between the ages of 3 and 5 from a low-income household is eligible.

Also, check with your employers. Many companies are now offering child care reimbursements that employers might not know about.

It’s timely, but when you file your 2021 tax return, you can apply for the Child and Dependent Care Tax Credit. You qualify to claim this credit if you pay someone to care for one or more kids while you work or look for work. Families can receive up to $3,600 per child.