(NewsNation) — Online shopping and in-person shopping used to be different experiences, but retailers are increasingly blending the two to make the most of their brick-and-mortar locations.

For more than a decade, online juggernauts like Amazon have accelerated a “retail apocalypse,” with major companies like Sears, Toys R Us, and most recently Bed Bath & Beyond shuttering stores.

The COVID-19 pandemic made things worse as health restrictions emptied shopping centers, changing consumer habits along the way. In April 2020, the New York Times declared “the death of the department store.”

But since the pandemic, shoppers have been eager to go back in person. U.S. brick-and-mortar retail revenue hit $6.18 trillion in 2022, up 11% from the year prior and outpacing online sales growth.

As a percentage of total sales, e-commerce purchases have more than doubled over the past decade but still account for just 15% of U.S. retail sales. And research shows most Americans across all age groups still prefer physical stores to online shopping.

“Digital is really key, but the role of the store is crucial and critical to the customer experience, and stores still represent a tremendous amount of retail revenue,” said Susan Reda, vice president of education strategy for the National Retail Federation (NRF).

Instead of abandoning in-store shopping, major retailers are updating their stores to meet consumers’ evolving needs.

Walmart recently announced plans to remodel hundreds of “Stores of the Future,” featuring “digital touchpoints” that will provide “more info on products and services.” JCPenney is set to spend more than $1 billion remodeling its stores as well as upgrading its app and website. Target has also spent big, updating its stores which now double as fulfillment hubs for online orders.

The look and feel of those futuristic stores will vary from retailer to retailer as more companies find non-traditional ways to make use of their space, said John Talbott, director of the Center for Education and Research in Retail at Indiana University.

“Historically, we viewed stores as a place for us to go and generally acquire something,” Talbott said. “Today, retailers are using stores as warehouses … [stores] can be a storage facility, they can be a transship location, they can also be a place to have fun and not necessarily walk away with anything particular.”

Retail stores: Where online meets brick & mortar

Going to the store and shopping online used to be opposites — you either did one or the other — but that’s no longer the case. Today, brick-and-mortar and e-commerce are intertwined, with more brands finding new ways to combine the two.

“Retailers don’t think of those as disparate entities anymore,” Talbott said. “They’re trying to take the best of each of those elements.”

That shift is in line with changing consumer behavior. More than 50% of shoppers now use their phones to buy or research items while they’re in the store.

Retailers have responded by adding more digital elements to physical merchandise. Scannable QR codes allow customers to order sizes that are out of stock at a specific store or learn more about the product they’re holding.

For environmentally-conscious companies like Patagonia, QR codes have been a way to express the brand’s values, reducing the amount of paper used in tags.

Other companies, like IKEA, have integrated QR codes to streamline the checkout process, enabling customers to scan their items as they shop and track purchases in real time. Fast-fashion giant Zara has used QR codes in creative window displays.

Mobile retail apps have also helped blur the line between physical and digital, further popularizing the strategy known as “omnichannel” — a sales and marketing approach that aims to provide a seamless shopping experience across all channels.

In practice, that could mean sending shoppers a discount at the exact moment they’re making a purchasing decision, allowing brands to tailor pricing specifically to individual customers.

New tech will prioritize convenience and fun

Retailers will deploy technology differently based on their target market, but Talbott says most have one of two goals in mind: create an experience that makes shopping more fun or solve a problem that makes shopping more convenient.

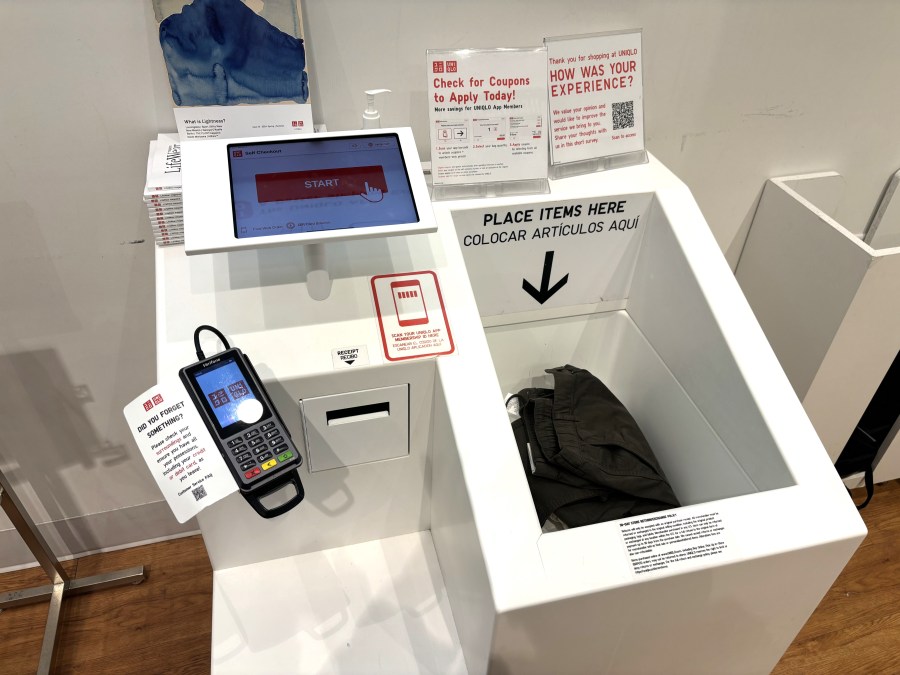

At Uniqlo’s State Street store in Chicago, customers no longer have to scan individual items. Shoppers can check out in one fell swoop by placing all their items in a bin, and radio frequency identification (RFID) chips help ring up the items. Uniqlo’s parent company, Fast Retailing, recently told the Wall Street Journal that self-checkout cuts wait times in half.

Other brands are gamifying the shopping experience by bringing their flagship brick-and-mortar stores directly to customers through realistic, virtual replicas. In November, furniture company Crate & Barrel launched a 360-degree digital recreation of its new 23,000-square-foot retail store in New York City.

Retailers like J. Crew and Bloomingdales have also launched cyber stores that let users shop in a virtual world.

Interactive graphic displays are also becoming more common. Major grocers like Kroger have rolled out digital smart screens that show which drinks are available in a cooler. Walgreens ran a similar test with mixed results.

The social media generation prefers to shop in stores

Young people are more online than previous generations, but that doesn’t mean they’re turning away from in-person shopping. In fact, adults ages 18 to 29 are more likely to prefer a physical store than those ages 30 to 49, Pew Research found.

Hungry for interactive experiences, Gen Z shoppers have been credited with helping malls bounce back after the pandemic downturn. Members of Generation Alpha, those born after 2010, are also starting to influence retail trends.

“Some of the retailers who truly cater to those generations have clearly debunked the myth that they only want to shop digitally,” said Reda.

The preference for in-person shopping may stem, in part, from the pandemic — a time when teenagers and young adults were isolated from their friends, Reda pointed out.

“They really like the communal aspect of shopping in stores,” she said. “The opportunity to have a social experience in the store — to actually pick up and play with products — that’s really important to them.”

As younger Americans’ spending power continues to grow, brands will continue to adapt physical stores to their needs. That will likely include an emphasis on speed and convenience, which are a main driver of Gen Z’s purchasing decisions.

Gen Z shoppers also have a “proclivity for brands whose values align with their own,” according to a recent survey from the International Council of Shopping Centers.