Gas prices: Will Biden tap into an emergency stash of oil?

Testing on staging11

CHICAGO (NewsNation Now) — President Joe Biden is strongly considering and is likely to announce Tuesday a plan to deal with high gas prices by tapping the strategic petroleum reserves.

Biden is already scheduled to speak on the economy and lowering prices for the American people.

In the last year, gas prices have gone up from $2.12 to $3.40. That is a 60.3% increase.

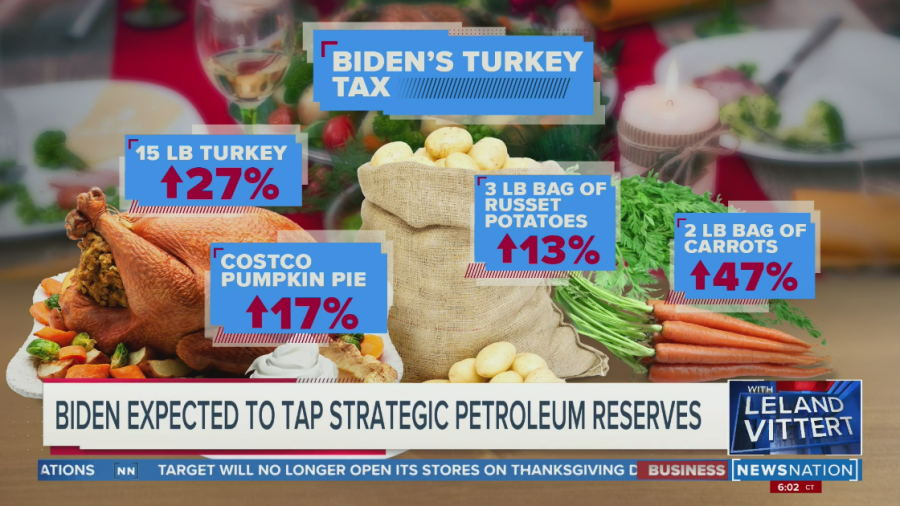

Americans are also facing high price on goods ahead of the holidays. Most Thanksgiving dinner components are up double digits.

NewsNation host Leland Vittert asked the former chairman of the Council of Economic Advisers under President Barack Obama if Biden is heading for a Jimmy Carter-esque next three years.

“You’d have to be worried on a political front versus on an economic front,” said Austan Goolsbee, who is now a professor at the University of Chicago.

Biden is facing dwindling poll numbers over his handling of inflation. On Monday, the president said it isn’t just the U.S. facing a rocky recovery from the pandemic.

“We know it’s tough for families to keep up with the rising cost of gasoline, food, housing and other essentials,” Biden said “It’s not just an American problem. It’s a worldwide problem.”

Goolsbee agrees.

“My own view is that much of what’s happening in inflation is coming from a supply constraint,” Goolsbee said. “That during the pandemic, people could not spend money on services, which is what we normally spend most of our incomes on, so we’re having record setting demand for physical goods in the United States and in every other advanced economy of the world, and the supply chain cannot handle that. And that’s why we’re getting inflation.”

Goolsbee believes the inflation is going to be temporary, but is still cause for political concern.

“They definitely need to be worried because even if you’re on team temporary, you think this is going to last for months. It’s going to be till next summer before you start seeing relief,” Goolsbee said. “And that’s not really on the political timetable that they’re comfortable with.”

Tapping the reserves is a short-term solution to a long-term problem and one of the three things the administration could do to lower prices, in addition to opening up more federal leases for drilling. Tapping the reserves is also the quickest thing possible by lowering prices.

Sources tell NewsNation’s Kellie Meyer tapping the reserves could mean 10 to 30 cents less a gallon at the pump in the next two to three weeks.

The move, though, could come with some consequences for Biden because he may face backlash from OPEC, the Organization of Petroleum Exporting Countries. They could turn around and decide not to increase output.

If OPEC reacts negatively to this move from the Biden administration, we could see gas prices then go back up by Christmas.