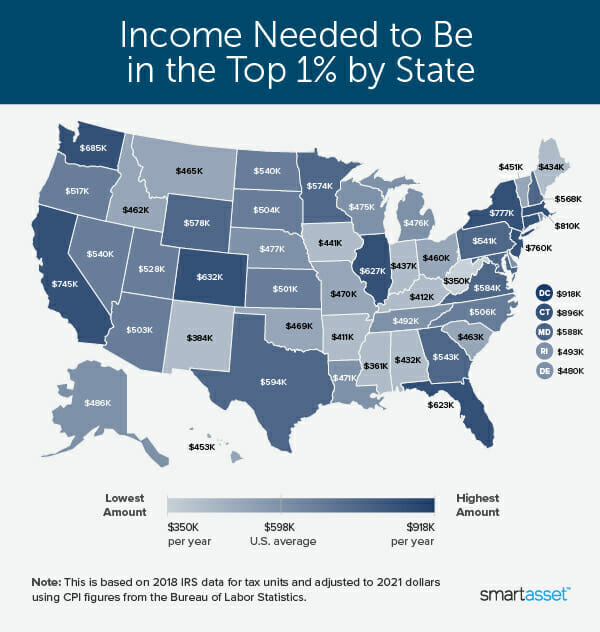

(NEXSTAR) – Have you ever wondered how close you are to being among the richest in your community? A new analysis by SmartAsset shows just how much it takes to be in the top 1% in each of the 50 states.

Using tax data from the IRS, the site was able to determine the minimum income required to be among the highest earners in each state. These figures were then adjusted to 2021 dollars using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the Bureau of Labor Statistics.

States were ranked based on the adjusted gross income of those in the top 1%. Adjusted gross income, or AGI, is your gross income minus adjustments to income, according to the IRS. Gross income includes wages, capital gains, retirement distribution, and any other income. Adjustments may include student loan interest, alimony payments, or contributions to a retirement account.

Your AGI is used to determine which credits and deductibles you qualify for while filing your taxes.

In its analysis, SmartAsset found an American family needs a gross income of $597,815 to fall in the top 1% of earners nationally. Those in the top 1% in the U.S. earn twice as much as those in the top 5% – a gross income of $240,712 is enough to put you in the top 5%.

The benchmark to be considered among the top 1% of earners varies by state. In Illinois, for example, you’d need an income of at least $627,000.

Here are the five states with the highest adjusted gross incomes to be considered among the top 1%:

- Connecticut: $896,490

- Massachusetts: $810,256

- New York: $777,126

- New Jersey: $760,462

- California: $745,314

Technically, Washington, D.C., which isn’t a state, has the highest AGI to be considered one of the highest earners at $918,000.

Alternatively, here are the five states with the lowest AGIs for the top 1%:

- West Virginia: $350,212

- Mississippi: $361,462

- New Mexico: $384,427

- Arkansas: $411,633

- Kentucky: $412,836

Don’t land among the top 1% of earners in your state? You may still be considered ‘rich’ in your community. Go Banking Rates recently released an analysis showing how much you need to be considered rich in 50 U.S. cities.

In Boston, for example, the lowest income required to be considered ‘rich’ is $159,024. In Albuquerque, New Mexico, an income of $106,866 makes you rich.